Obligations To help you Money Proportion: Determining The To Secure Home financing

People have some borrowing. Whenever trying to get a mortgage, you need to know financial obligation in order to income ratios to choose if it is likely so you can feeling your ability to help you secure home financing.

The lender will have to determine if you may have most other pre-current costs, as well as how far to own, it is therefore usually wise to consider it prior to an enthusiastic software to be certain you don’t exposure a rejection that can damage your credit score.

For individuals who still have to, you could potentially demand an excellent callback immediately that works to own you or click the option less than to locate an aggressive, safer financial offer.

What exactly is a personal debt to help you Income Ratio, and just why Will it Matter?

A financial obligation in order to money proportion talks about how much cash you need to invest every month on the debts, than the everything earn. The gains contour is terrible, so in advance of taxes and every other deductions.

Basically, which proportion shows a loan provider exactly Pinecraft payday loans online how much personal debt you are in, than the everything secure to evaluate just how risky the job are.

- Add up your monthly repeating financial obligation payments.

- Sound right your own monthly gross income and wages, plus positives.

- Separate the fresh expense because of the earnings, right after which multiply because of the 100 to obtain a share.

As an illustration, for many who pay bills of ?step one,000 a month and you will secure ?2,five-hundred, your debt so you’re able to earnings proportion is 40%.

Exactly what Expense are part of a home loan Financial obligation to Earnings Proportion Calculation?

- Financing and credit cards.

- Student loan repayments.

- Youngster service money.

- Mortgage repayments otherwise lease.

- Vehicles funding.

- Obligations Government Plan repayments.

Having debt doesn’t invariably imply you will not be approved to have a good financial – and you may actually look at remortgaging in order to combine other expenses and you will improve your outgoings.

This new feeling is based on what type of personal debt you really have, how good-sized the fresh money is, and you will exactly what your websites throwaway earnings turns out.

Exactly what Financial obligation in order to Money Proportion is suitable to own a mortgage Vendor?

The low brand new proportion, the newest faster personal debt you’ve got, thin much safer the job. A ratio around 20% to 30% can be considered reduced chance and also be provided ideal attention cost.

If you have a high loans so you can money ratio more than 50%, normally advisable to clear several of one to debt before you apply to have home financing, because would mean the pricing you are quoted will end up being smaller aggressive.

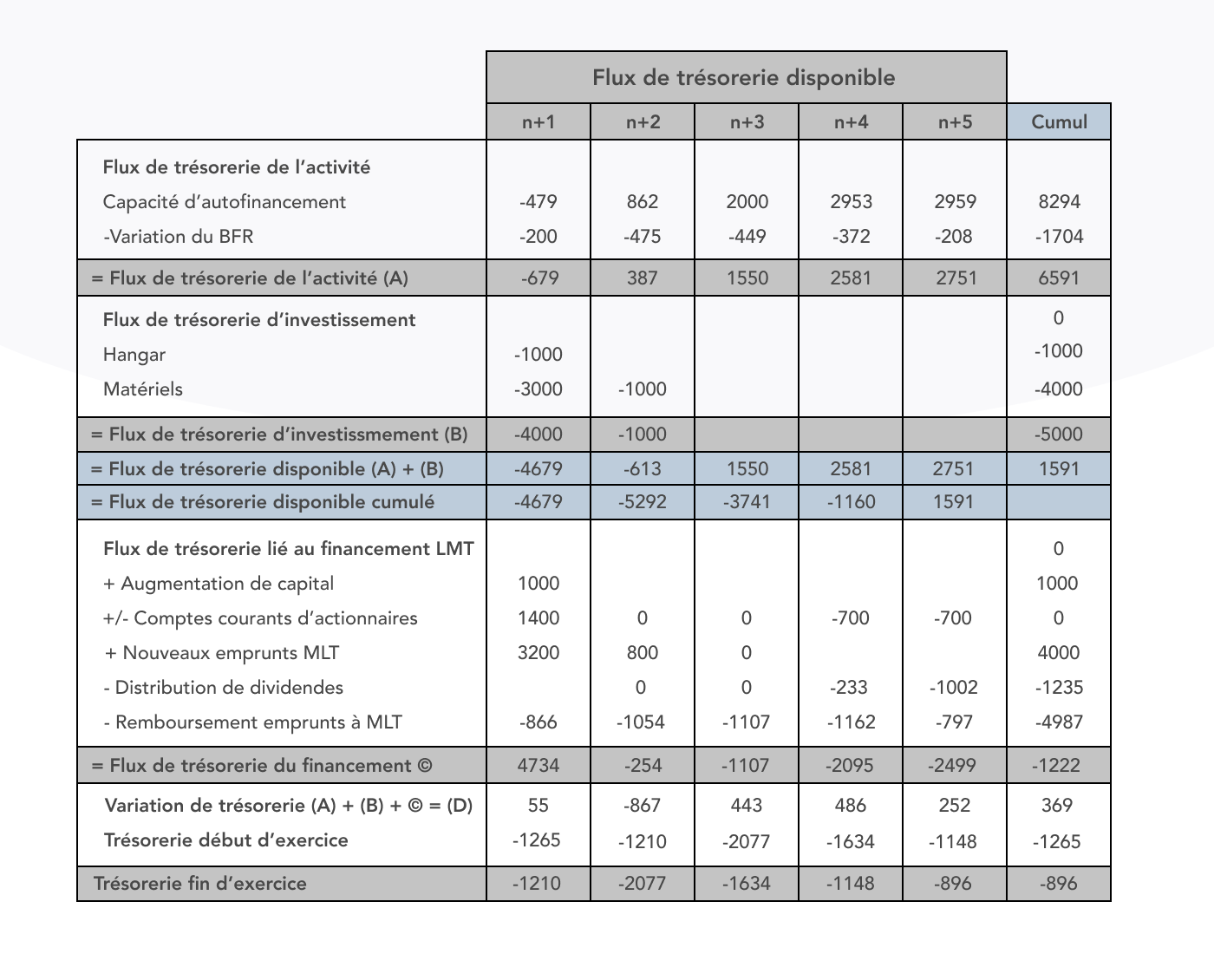

As the a rough idea, the below desk suggests a few examples regarding obligations so you can income percentages, and you will what which may imply for your financial application:

The actual only real options inside circumstance would-be a mortgage reliant into the other variables outside personal debt-to-earnings rates, based on most other cost computations.

Essential is my personal Personal debt in order to Income Ratio in enabling an excellent Home loan?

Most United kingdom loan providers commonly trust financial obligation in order to earnings computations to help you work-out if or not you really can afford a mortgage – not, not all the lenders are certain to get a comparable guidelines in place, or reduce a similar ratio in the same way.

Most of the time, your own monthly financial can cost you must be inside a particular commission of income, and more than loan providers will cap their personal debt so you’re able to income proportion and you will perhaps not give so you can somebody significantly more than that level.

Try Obligations so you’re able to Money exactly like my personal Credit rating?

No, talking about a couple something different. You could have a top debt so you can money ratio but a beneficial a good credit score rating, the lowest credit score, and you may a reduced personal debt to help you earnings proportion.

Borrowing referencing bureaus do not know simply how much you earn hence check your credit performance and you will money record, recording any items.

Comments

There are no comments yet.