Once paying years of your life time earning a sophisticated education and you may starting when you look at the a worthwhile profession, you may think taking a mortgage to buy a property carry out become a beneficial breeze. But as many medical professionals, solicitors or any other growing professionals with little deals and you may high financial obligation plenty know, qualifying for a conventional mortgage isn’t necessarily so easy.

Luckily, of a lot loan providers know the unique disease of such more youthful gurus and offer unique finance, known due to the fact white coat mortgages, customized particularly for all of them. These types of private money realize that while particularly specialists could have highest obligations and less savings than peers in other specialities, they also have seemingly large career and earnings security in the years ahead. Thanks to this upcoming financial balance, of a lot finance companies are able to relax several of their requirements to possess home loan lending.

Being qualified to possess a health care provider home loan

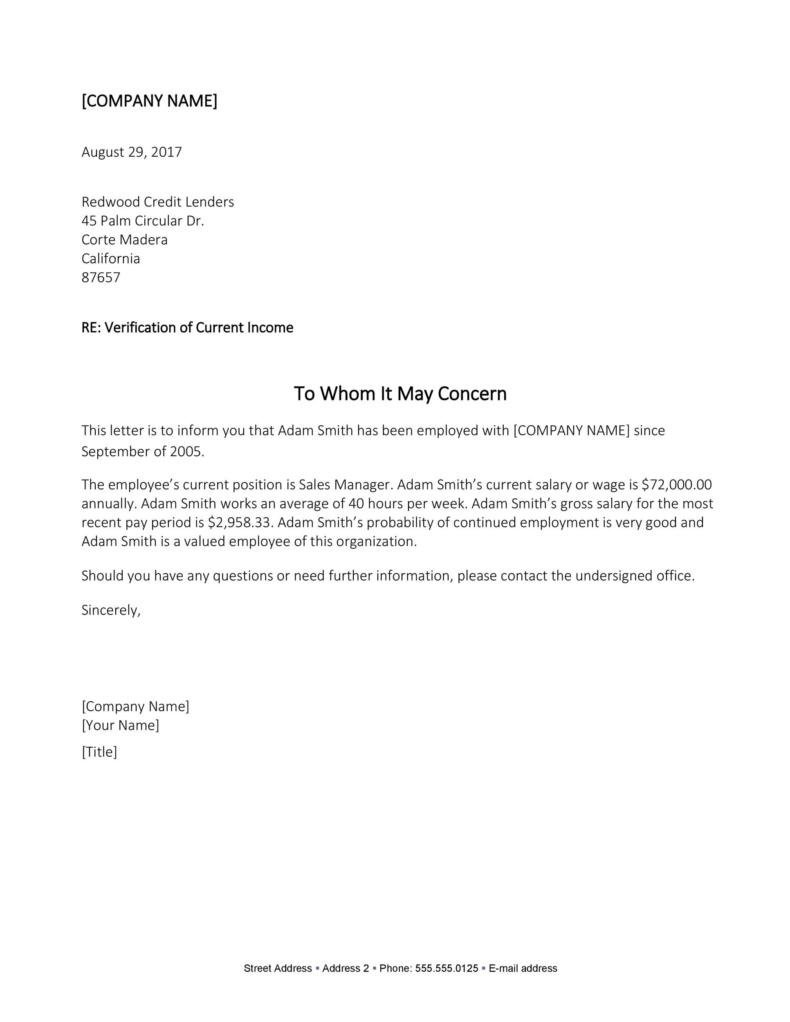

Generally speaking, but not, this type of loans generally dont penalize candidates for having higher profile away from student education loans and have now lower requirements to down money and you will the debt-to-money ratio. Needed proof your own a position (otherwise an union having upcoming work) and paycheck.

From the Countries Bank, one medical medical practitioner, including customers, fellows, physicians of dental medicine and physicians out of osteopathy, can put on to own a mortgage thanks to Regions’ D. Candidates will get be eligible for loans as much as $1 million and you may lower-down-payment solutions to $step 1.5 mil.

The fresh Nations Emerging Masters System try accessible to lawyer, certified pharmacists, nurse anesthetists, physician personnel, nursing assistant practitioners, optometrists or podiatrists who have been exercising getting seven many years or a lot fewer. This program brings financing as high as 97% regarding a beneficial property’s really worth doing $766,550.

Keep in mind that when you find yourself lenders will not disqualify your mainly based on harmony of your own student loans, try to become newest on your student loan money.

Some great benefits of a health care provider mortgage

Due to the fact greatest financing for you relies upon your own personal financial predicament, there are a few prospective positive points to using a health care provider mortgage so you’re able to pick property. A person is the capacity to make a purchase with little to no otherwise no cash off and you can without paying for financial insurance. (Having a vintage mortgage, people that set out less than 20% towards the a property get generally need to pay an extra commission per times having financial insurance coverage, as the banking companies thought them riskier consumers.)

Another advantage to that particular version of financing is the capacity to personal to your mortgage prior to starting a career (if you typically need http://www.elitecashadvance.com/installment-loans-nc/bolton a position provide already available). Which may be like of use when you find yourself transitioning out-of college student housing otherwise relocating to a new area for your job and you will you would like a destination to real time straight away. Furthermore diverse from conventional mortgages, and therefore generally speaking wanted pay stubs as well as 2 many years of tax returns to prove your earnings as well.

Finding your way through home financing application

Regardless if you are obtaining a timeless home loan, a physician mortgage or other sorts of loan, there are numerous actions you can take and then make your self an even more attractive debtor so you can lenders. Begin by asking for a duplicate of your own credit history (obtain it at no cost from the annualcreditreport) to ensure it’s specific and you can getting steps to improve their credit rating. That might are settling high-desire debt, including charge card stability, and you will to avoid taking right out brand new fund instantaneously before applying to possess a home loan.

You can even explore a mortgage calculator and you can newest interest rates to find a sense of how much cash monthly mortgage payments do costs depending on the spending budget of property you’re considering. It may be helpful to consult a lender discover away what types of mortgage loans you might be eligible for, to choose which one helps to make the most experience for your debts.

While a health care professional home loan may well not wanted a big deposit, you might still have to build some money supplies previous to creating the acquisition. Also closing fees and you may moving can cost you, additionally, you will desire an emergency fund available to safety the brand new unforeseen will cost you-including a leaking roof or a cracked hot water heater-you to definitely invariably have homeownership.

Controlling student loans and you will a mortgage

In the event the bank isn’t really factoring your student loans in their mortgage recognition choice, you nevertheless still need in order to factor all of them into the funds, after you’ve finalized for the mortgage. In spite of how highest your income, it’s important to has a decide to manage your financial and you may the student education loans, as well as build improvements on the other monetary desires, including saving getting old age otherwise getting currency out having an effective baby’s degree.

You can determine whether your qualify for one combination or refinancing choices for the figuratively speaking, and that ount that you spend to the particularly money each month and you can improve your repayments. When you have federal figuratively speaking, you s, like the Shell out As you Earn package, otherwise Public-service Loan Forgiveness (in the event the manager was a beneficial nonprofit otherwise regulators service).

When you are paying off your college loans, you are able to wish to be mindful to end very-called lives slide, in which their expenditures start to rise along with your money. To get an alternative vehicle or the fresh new closet to choose your new home and you may the new jobs is tempting, consider carrying regarding up until you have built up your crisis fund and generated even more progress into the paying off those individuals funds.

Physician finance or mortgage loans for emerging masters is a sensible means for more youthful early-profession specialists becoming homeowners. If or not make use of these types of mortgage otherwise a traditional financial, it is critical to provides a strategy based on how you are able to do the fresh new the brand new costs as well as college loans or any other present loans.

Comments

There are no comments yet.