Sam relays what must be done to qualify for home financing for the terms of credit rating, and you may personal debt stream, for instance the unique way deferred college loans enjoy towards calculation

Within episode, Emily interview their sister, Sam Hogan, a home loan inventor that have Prime Credit (Note: Sam now works at Us Mortgage) whom focuses on PhDs and you may PhD youngsters, including men and women researching fellowship income. The guy details the newest unusual strategies he’s got discovered over the past season at work with PhD subscribers to help them become approved having mortgages, even with low-W-2 fellowship earnings. At the end of the latest interviews, Sam offers as to why the guy wants handling PhD home buyers. Over the past year, Personal Funds getting PhDs has actually referred plenty company so you’re able to Sam which he might an advertiser to your podcast.

- Get in touch with Sam Hogan via cell phone: (540) 478-5803; otherwise email: [email secure]

- Listen to an earlier episode which have Sam Hogan: To purchase a house since a scholar Beginner having Fellowship Money

- Relevant occurrence: Which Grad Pupil Defrayed His Property Costs By Leasing Rooms to help you Their Co-workers

- Personal Fund to possess PhDs: Economic Coaching

- Private Funds to own PhDs: Podcast Centre

- Private Fund getting PhDs: Subscribe to brand new email list

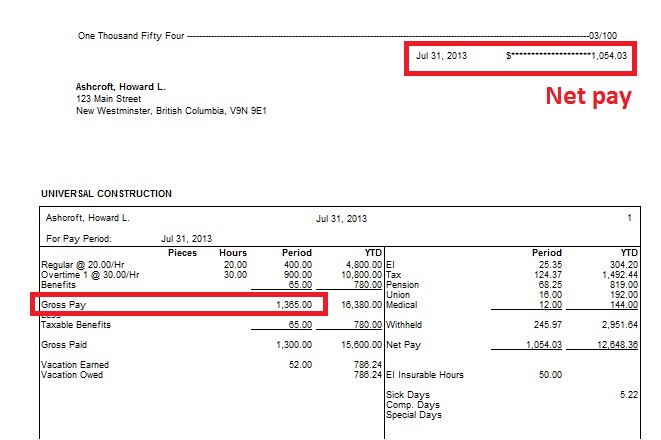

Sam relays what must be done to qualify for a mortgage when you look at the regards to credit rating, earnings, and you can loans load, including the special way deferred figuratively speaking play to your calculation

Sam: It certainly is ideal for a good PhD student to-be because the hands-on that one may. I’ve seen characters having three years of continuance, but they’ve got attained out to me personally once one to semester has gone by. Today they merely have two-and-a-half numerous years of continuance, where anybody, once they got hit away per year earlier regarding their coming, as well as how they have been going to buy domestic once they was indeed into the a different sort of city, that is the prime slam dunk treatment for do it.

0:33 Emily: Thank you for visiting the private Loans for PhDs podcast, a high training inside individual loans. I’m your own host, Dr. Emily Roberts. This will be Seasons 5, Episode 17. Now, my personal guest is actually Sam Hogan, a mortgage founder that have Primary Lending (Note: Sam now works within Movement Financial) which focuses on PhDs and you will PhD students, including those individuals finding fellowship income. Sam information the latest uncommon procedures he has got discovered over the past season in the office with PhD subscribers to assist them become approved to possess mortgages, even with non-W-dos fellowship income. At the end of the latest interviews, Sam offers why he wants dealing with PhD household-consumers. For the past season, Individual loan places Noroton Finance to possess PhDs have called much providers in order to Sam which he might an advertiser into podcast. In place of then ado, here’s my interviews with my sibling Sam Hogan.

Emily: I am appealing back into the podcast today. My buddy Sam Hogan, that is mortgage originator. He sells mortgage loans. And you will Sam was for the podcast ahead of in 12 months A couple, Occurrence Five. It absolutely was whenever you are we have been tape this to your and then he was past with the about a year ago. During the time, we had been talking about how somebody having fellowship income may actually score a mortgage – non-W-dos fellowship earnings as the tis is actually a difficult issue we discussed in this episode. So now, as i told you, it’s been a-year since, Sam’s addressed much more mortgages of this type and so the guy knows more about this step now. And so i consider we’d enjoys your right back towards the to own an improvement, generally, and you will more record towards the bringing home financing once the good scholar scholar otherwise postdoc otherwise PhD. Therefore, Sam, greet back to brand new podcast. Thanks a lot getting coming back toward. Can you delight simply tell the listeners a couple terms from the oneself?

Comments

There are no comments yet.