Many very first-homebuyers check out tiny land to get a foot to your the house hierarchy, thus now our company is getting clarity with the will perplexing activity of getting loans, home financing, otherwise a mortgage to have a small home.

Really little house are considered portable auto. This means they won’t constantly meet the criteria for a property loanbine this lacking in obvious credit criteria away from of a lot monetary team, and those trying to alive a giant lifestyle in a tiny household are left moving because of much more tough hoops.

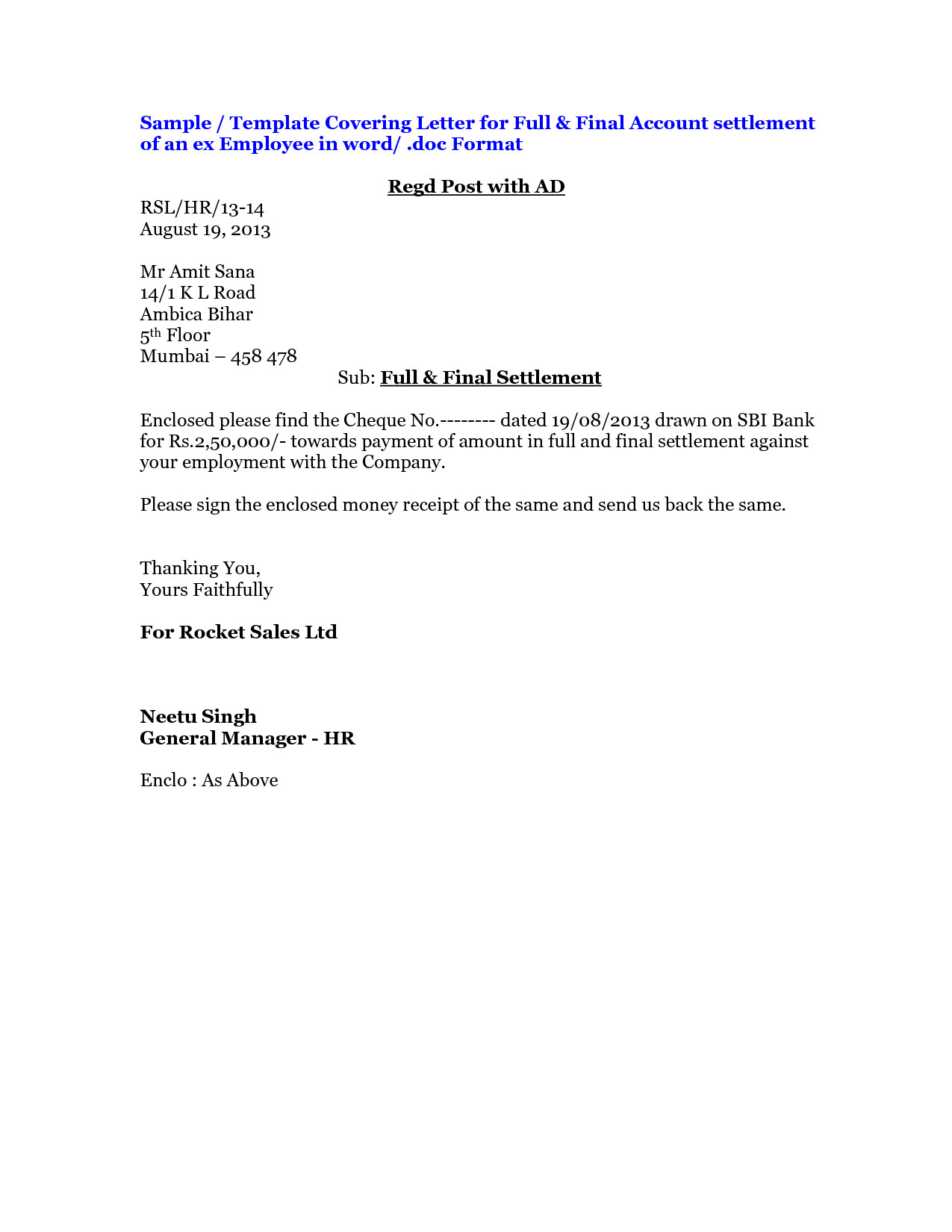

Can you rating home financing for a tiny domestic? Home financing? Do you require their Kiwisaver? What capital choices are available? In the place of clear responses, Kiwis usually are leftover in the dark with respect to financing a little domestic.

Luckily, there is certainly light which shines at the end of your tunnel. Any type of inquiries you could have, now we are sharing every answers and you can information you need to help you see so you’re able to make funding your own little household that much simpler.

Did you realize? You can buy a mortgage to possess a great Podlife Pod. Glance at all of our range otherwise keep reading to learn more.

Secure home financing with an excellent Podlife Pod

Securing funds for your dream (tiny) family will likely be challenging. Fortunately, it will not need to be. Here at Podlife we retain the council acceptance and you will conformity procedure for you, so that you can also be safe an effective Podlife Pod that have a home loan. Its that easy!

Explore a current https://cashadvancecompass.com/installment-loans-ca/windsor/ mortgage just like the influence

When you’re lucky enough so you can currently get on the house ladder, you can toward established home loan to cover your lightweight domestic. Because mortgage interest rates try somewhat below other options, the loan will cost you quicker in the long term.

When it comes to buying property, timing was that which you. You have overlooked the ability to get a home at a good speed and you will, thus, don’t possess a home loan to use given that power. In this instance, you ily affiliate.

The lending company away from Mum and Father has long been an easy method to have Kiwis to find onto the possessions ladder. You could install a legal plan to pay for cost can cost you, therefore Mum and you can Dad enjoys peace of mind once you understand they aren’t likely to be lumped which have the latest, unanticipated obligations.

Come across an option lender

Independent financial support organizations instance TMFNZ ltd and you will Squirrel Currency is actually agreeable for the tiny family path. They provide low interest rates and you can punctual loan pre-approval.

In the event your small home is transportable, you are able to meet the criteria for a financial loan regarding Borrowing from the bank That. Credit You to money amusement car such as for instance RVs, caravans, motorhomes and trailer home.

Make use of the equity from your own parcel of land

For many who have property, you really have enough equity to finance your lightweight house. Assets prices are expanding a week, thus there’s a high possibility the guarantee is continuing to grow, even if you just possessed the fresh new home for a short time.

Get home cherished by an authorized assets valuer showing the financial institution their level of equity. Depending on how much you have got, you are able to guarantee to increase the loan or safety brand new make entirely.

Pull out a personal loan

Fundamentally, the a lender must look for is a steady flow of money and you will good credit score. Consumer loan interest rates was notably higher than home loan rates, although mortgage title is a lot reduced. According to your bank’s words and personal circumstances, you’re in a position to use as much as $80,000.

You are able to your own Kiwisaver to your small domestic project, however, just to financing new home to build they with the.

You can find strict terms and conditions out of with your Kiwisaver to buy an effective home, similar to the regards to your financial. In case the smaller home is linked to a truck, it would be experienced an auto. You simply cannot draw off the Kiwisaver finance to get an auto.

not, you’re eligible to use your Kiwisaver towards your generate if you possibly could show that the lightweight household:

- Try a permanent, immovable dwelling

- Is restricted so you’re able to strong foundations

- Meets related strengthening requirements

- Won’t be transportable in the future

Investment a small house doesn’t need to be difficult

When you are there may be too little monetary business within the The fresh new Zealand providing loyal (tiny) mortgage brokers, we hope today’s blog post were able to create your travel to lightweight owning a home a small simpler. Towards feet cost of an effective Podlife Small Home doing on a lower rates than a classic home, it is worth your while.

Do you want to start the lightweight house endeavor? Have a look at our very own earlier in the day websites for lots more desire and make certain to test right back later on as we continue steadily to mention brand new rooms where relaxed Kiwis real time, really works, and you can gamble!

Comments

There are no comments yet.